Design to Target

He who knows his customers gets the business.

Anyone who has presented an object, an antique, a piece of art or any product to different people is familiar with the phenomenon: some viewers like the object, others do not.

Another peculiarity is also apparent: it is always the same people who decide on a certain type of design, even though the objects are completely different. Be it clothes, accessories, furniture or technical equipment.

This shows that people have a strong sense of the visual appearance of the environment and tend to develop personal preferences. These personal preferences result in the individual selection of the surrounding objects. This personal selection is referred to as the personal style. Although this is considered to be very individual, these personal styles resemble each other to such an extent that they can be summarized in different style groups.

Because human perception is selective, the persons in a group identify the features of their own style very well and tend to sort out information which was meant for other style groups. Hence, every style group creates its own culture by developing its own demands and satisfying them with suitable products. After some time, the style groups differ so much that society forms different lifeworlds whose members are focussed so intently on their own style that they hardly recognise other information meant for other lifeworlds (more on this effect under “POS”)

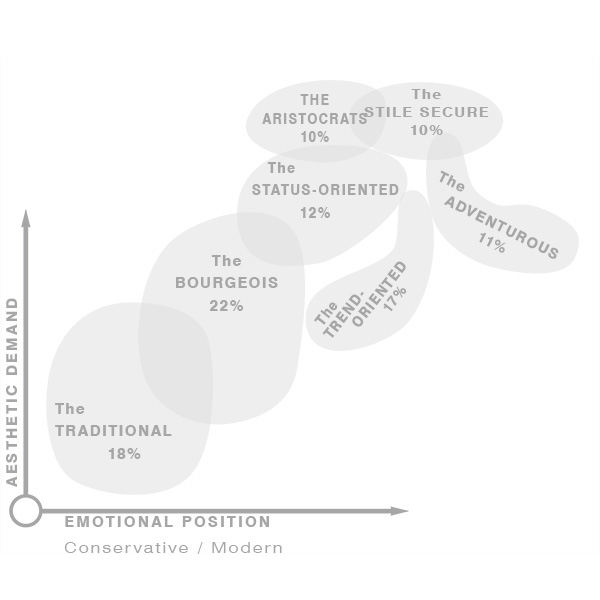

In Central Europe, research on lifeworld categorises consumers in seven lifeworlds or style groups. These groups are arranged in a comprehensible matrix, which shows the conservative or modern view of life set in relation to the demand for aesthetic quality. Further qualitative observation facilitates the allocation of brands and products to the different lifeworlds of the style groups.

In Central Europe, research on lifeworld categorises consumers in seven lifeworlds or style groups. These groups are arranged in a comprehensible matrix, which shows the conservative or modern view of life set in relation to the demand for aesthetic quality. Further qualitative observation facilitates the allocation of brands and products to the different lifeworlds of the style groups.

When introducing a new product to the market place, this knowledge of the lifeworld and the specific style groups can be used to identify possible target groups which are not adequately covered by existing products. The example shows the positions of the most important brands represented in the German automotive market.

When the flat target group matrix is converted to a volume, this system offers a very detailed but yet very systematic view of the market place. By dividing the market volumes into upper, middle, and lower price ranges, the active brands or products can be positioned vertically on the basis of the average price of the model.

When the flat target group matrix is converted to a volume, this system offers a very detailed but yet very systematic view of the market place. By dividing the market volumes into upper, middle, and lower price ranges, the active brands or products can be positioned vertically on the basis of the average price of the model.

In this representation, market gaps immediately become obvious. In the example, it is clear the lifeworld of the trend-oriented and the adventurous is only sparsely covered in the middle and upper price range.

As these groups are looking for unique and unusual products and are willing to pay high prices for brand-name products that reflect the modern attitude of the owner and hence, a large market volume exists.

Manufacturers could make optimal use of this gap by placing the new SUV cars here. The stunning success of the SUV cars can therefore be explained by the relatively low density of suitable products in these target groups.

Once identified, the free market may be investigated to determine some form of language, colour moods or materials that best address the style group. Pictures and other information about specific outlets, the most popular brands and successful products as well as their means of communication can be collected to obtain all market-relevant information. This helps significantly in defining the selected goal and paves the way for the coordi-nation of the various product-related activities such as development, manu-facturing, communications and sales.

In addition, the means of communication, the product and the product environment can be verified by volunteer subjects of the specific style group thus leading to an enormous increase in accuracy.

The style group methodology gives the client and SYNTHESIS a clear view of the consumers and the market place.

PDF Download

PDF Download